Welcome to Friday. I hope you had a good week. I know I sound like a broken record, but where did this week go? I sent the artwork to David last night to make the images and banner and he said, “Didn’t I just do this?” It feels that way to me as well.

We’re only three weeks away from Labor Day weekend. Autumn is my favorite season and normally I’m counting down the days until I can put out my fall decorations. For some reason, I’m not looking forward to fall this year. Well, it’s not “for some reason.” It’s for many reasons, some of which I elaborated on in posts last week. There is just so much sadness and brokenness everywhere and there was more this week. There is so much suffering right now.

By the last week of September my unsettled feeling about other things will be resolved one way or the other. Sorry to be cryptic, but I’m just being honest. A lot of what I’ve been observing and anticipating for the past several months will culminate over the next six weeks, one way or the other. That will tell me a lot about what to anticipate (or not) heading into October and beyond.

To be a bit more clear, I’m watching to see if some very significant events occur before the end of September that would move our country forward in a significant way. If they don’t happen, then I’ll have to adjust to my thinking accordingly. I would not put money on any of them and I’m not date setting or predicting anything. They are simply markers I’ve personally had for several months based on things a WIDE variety of unrelated people from different perspectives have said or written about that all kind of converge in a weird way at the same time. I’ve not written or spoken about any of them publicly although I’ve discussed them with a handful of people in real life. Now I’ll find out one way or the other.

I will tell you this. You want me to be right in what I’m looking for. LOL!

This Week’s Artwork

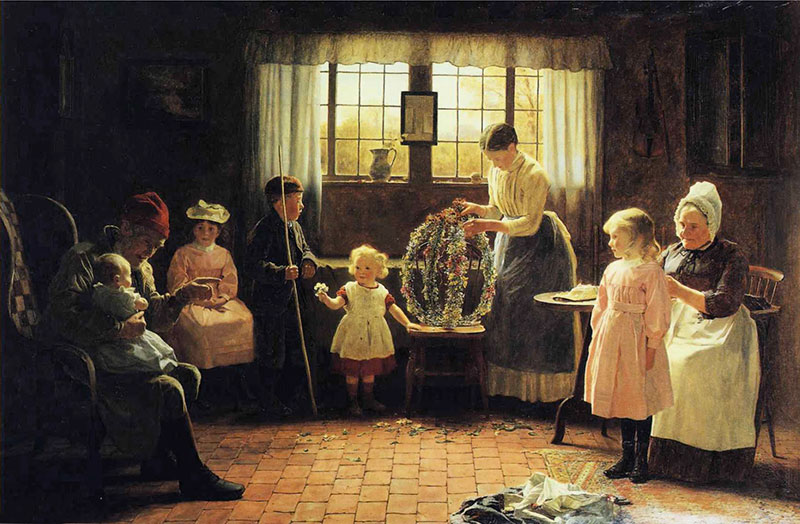

Today’s art is May Day by James Hayllar.

I featured Hayllar in Simple Living This Week No. 90 so I won’t do his bio again. You can read it in that post. May Day was a big deal in the past. I have a Michigan State College (University) yearbook from 1920 and there is all sorts of stuff like May Day celebrations in there. It was a different world.

In any case, it’s a lovely, homey painting.

Homeschooling

We are up and running again. Starting slowly and adding a bit each day. I don’t have a post about what we’re doing because we don’t do things in the typical way. But we have started and eventually I’ll write about it.

Homemaking

Like all of you, our expenses have been going up through no choice of our own. Our natural gas bill is set up for the same amount each month so it spreads the cost of winter heating out over the year. (We also have a gas dryer, gas stove/range, and gas water heater.) Our settlement month is October and clearly our monthly amount was not going to keep pace with the rising costs. So this month they tacked on an extra $116. They will add the same amount next month, I’m sure. I cannot imagine what our new monthly amount is going to be. I’ve mentally prepared myself for 3x what we are currently paying and even that may not be enough.

Similarly, all of our other bills (water, electric, etc.) have been going up even though we’ve taken additional steps to reduce our usage at the same time. Sadly, we’re way past the point where the average family is going to be able to reduce their usage enough to off-set the increases.

So this week I spent time going over all of our expenses, determining what we can eliminate. We already live pretty bare bones on the extras compared to most people. For example, we only spend $30/month for our primary phone that is “my” phone and David uses a flip phone that we buy minutes for. (Clearly, we are not phone people.) We have no streaming services except Disney+ (Caroline’s main source of entertainment). We don’t eat out as a family, but get take-out for Caroline once a week as a fun activity (Panda Express, Chipolte, etc.). We don’t have any kind of “entertainment” budget. We make our own fun at home.

In our case, even some little luxuries are going away. For example, here’s what I came up with in this go-around.

- The Epoch Times – $10/month (I like their website content, streaming, and supporting other news sources, but not now.)

- Brave Talk – $7/month (I’ve been using this for weekly online meetings, but Gab Voice was released this week for PRO members so I can use that for free and eliminate this cost.)

- SirusXM – $15.77/month (I seriously ♥ Ch. 76 Symphony Hall, but it’s not a necessity so I’ll be cancelling it today. This one does make me sad.)

- Feed.it – $10.00/month (This is the feed service I offer on my website. It will probably be going away next week because I’m also paying for a newsletter service and it seems redundant to pay for both. I know they aren’t the same, but that’s probably on the chopping block. So if you use Feed.it, make sure you are a newsletter subscriber. There is also the OneSignal Push Notifications option.)

I share this to encourage you to do the same thing. We don’t have that many things left to cut of this nature because we’ve already cut so many of them. But all of those little bits add up and most people don’t realize how many of those little expenditures they have on autopilot every month.

Someone might say, “But that’s only about $4/week for SiriusXM and you really like it.” That’s right. It’s only $4/week, but all those expenditures add up to about $43/month or $516/year. When inflation on everything is going up at the rate it is, that $43/month will be needed for other things (like heating).

The reality is that most of us spend so much money on things that didn’t even exist 20 or 25 years ago. There are almost always work-arounds and other options. It’s a matter of priorities and I don’t think it’s going to get any easier for those of us in the so-called middle class any time soon.

Home Business

This week I spent less time on working since we started back at homeschooling. I have multiple, partially finished posts that I could not carve out time to finish. Hopefully over the weekend. I have one about some of Caroline’s recent creative projects and a new free printable (for women, not children).

The big thing I did on Saturday was redoing the front page of my website. I almost got it done, but ran out of time. Hopefully I can finish it up this weekend. I’m very pleased with it. It’s about 80% done and geared specifically toward people who are new to my website.

I did get some things published. The new posts and podcasts included:

- Sallie’s Rebuilding America • Episode 37 – “Devolution For Dummies” By Burning Bright

- Sallie’s Rebuilding America • Episode 38 – FBI Raid On Mar-A-Lago

- We Made An Easy Squirrel Feeder Picnic Table

I also added many new forum posts in a variety of topics.

So that’s my week. What did you do this week? I hope you’ll leave a comment and share! ♥

We Made An Easy Squirrel Feeder Picnic Table

We Made An Easy Squirrel Feeder Picnic Table

Good morning Sallie,

I know I am being redundant when I tell you how much your posts inspire forward action, confirm the signs of imminent struggle, and encourage me that the Lord is certainly in control.

In the “create additional income streams” I have recently sold a beef steer and replaced it with two bred cows with money left over. I have been selling the duck eggs (my ducks outlay my chickens 2 to 1 and their eggs are superior for baking).

In the “make do, stretch it out, and use it up” category I have finally achieved a productive garden this year. Adjusting to the early and late frost gave been defeating me up until this year. I have gained on that learning curve and have had extra produce to put up for the coming year. Drying the peas, carrots, squash and potatoes is very gratifying.

Second on cutting costs, we have historically heated with a wood burning stove, keeping the propane forced air heating system in reserve (rather the flip of your secondary fireplace in the event the power goes out). I have taken to hanging the laundry to dry and only using the dryer to fluff the very stiff items. We have a screened in porch that works well for hanging out the laundry on wet days (bless the Lord for His rain).

We utilize, heavily, the Kroger fuel points to get substantial discounts on fuel by buying gift cards for stores from which we buy goods for farm projects (this has been my largest leveraging of budget). I also purchase the family gift cards for birthdays which makes the teens in the family happy while alleviating the stress of choosing presents.

We have an entertainment budget limited to buying DVD’s from the second hand book store.

I shop the sale items from 3 grocery stores on Wednesdays (that is town day). This is a good strategy for working the pantry while saving money. I can honestly say that the fuel and grocery bills are the expenses most affected by the current inflation.

I recently repurposed a stack of spent blue jeans into outdoor blankets. The blue jean throws are great for lap robes in the fall.

Our food waste is nill because the chickens, dogs or compost bin account for all organic matter. Thus our dump fees are reduced.

I am looking forward to down loading your holiday planner. I am planning on focusing more on gatherings and holiday meals that buying gifts…I believe we have a general consensus in the family and in our community to reject consumerism.

Wow, way long comment, but it has been a busy month.

Please continue to keep the light shining.

Hi Bonny,

Thank you for your kind words and the interesting update! Wow. You are doing so much and it’s inspiring to read it all.

That is really interesting about the Kroger fuel points. Would you be willing to explain it in more detail for others who might benefit from that tactic?

Sallie

Both Kroger and Safeway (I think Randal’s in the east) have a fuel point program tied to both their value savings cards. I find the grocery points do not add up fast enough to be worthwhile but purchasing the gift cards can get you up to $1.00 off per gallon.

In general the stores offer double fuel points on gift cards. If you wait for the digital coupon (usually offered around holidays like Valentine’s Day, Thanksgiving, etc.) you can get 4 times the fuel points. An example would be purchasing $200. Worth of Home Depot gift cards for a building project which would net you 80¢ off of a gallon of fuel ( up to 35 gallons). We usually take extra fuel cans because our truck generally doesn’t take 35 gallons and we don’t want to waste the discount. We then use the fuel can to fill the tractor and other equipment on the farm.

As a note, Kroger also offers a credit card that gives one an extra $25¢ per gallon discount when using Kroger fuel stations.

This strategy requires some forethought, budgeting, and diligence watching the adds but I have found it to be one of my best budget stretching tools.

I hope sharing this info helps others.

We just got back from vacation, and I’m working on finding a good cleaning balance because what I’m currently doing is not working.

Finding expenses to remove can be hard, I’m looking at figuring out some things to work through again, and it’s never fun.